Nokia just completed a capital raise. Normally, capital raising is more of a routine exercise and not a reason for euphoria. However, in this case, there is reason for excitement, considering the involvement of one notable name: Nvidia.

Nokia’s recent cash infusion does more than increase its share count. It effectively integrates the business into Nvidia’s AI networking plans, a move that benefits both parties at a time when Nvidia is about to report earnings.

The recent stock issuance to Nvidia, in the form of American Depositary Shares, translates to a roughly 2.9% stake in Nokia for the chipmaker. This acquisition corresponds to around 2.9% of Nokia’s total shares now available.

The financial infusion, a proposed $1 billion at $6.01 a share, comes as investors gear up for what has become a marquee event on Wall Street: Nvidia’s earnings.

Nvidia’s next earnings announcement will reveal more than simply the number of AI processors it’s shipping to data centers. The chip giant will provide an update to investors on its fiscal 2026 third quarter.

Wall Street anticipates over $54 billion in sales, expecting another significant year-over-year increase driven by demand for AI infrastructure.

For Nvidia investors, the burning issue as results approach is clear: How significant is the Nokia agreement for Nvidia’s upcoming AI expansion, and will the company provide any concrete figures on the call?

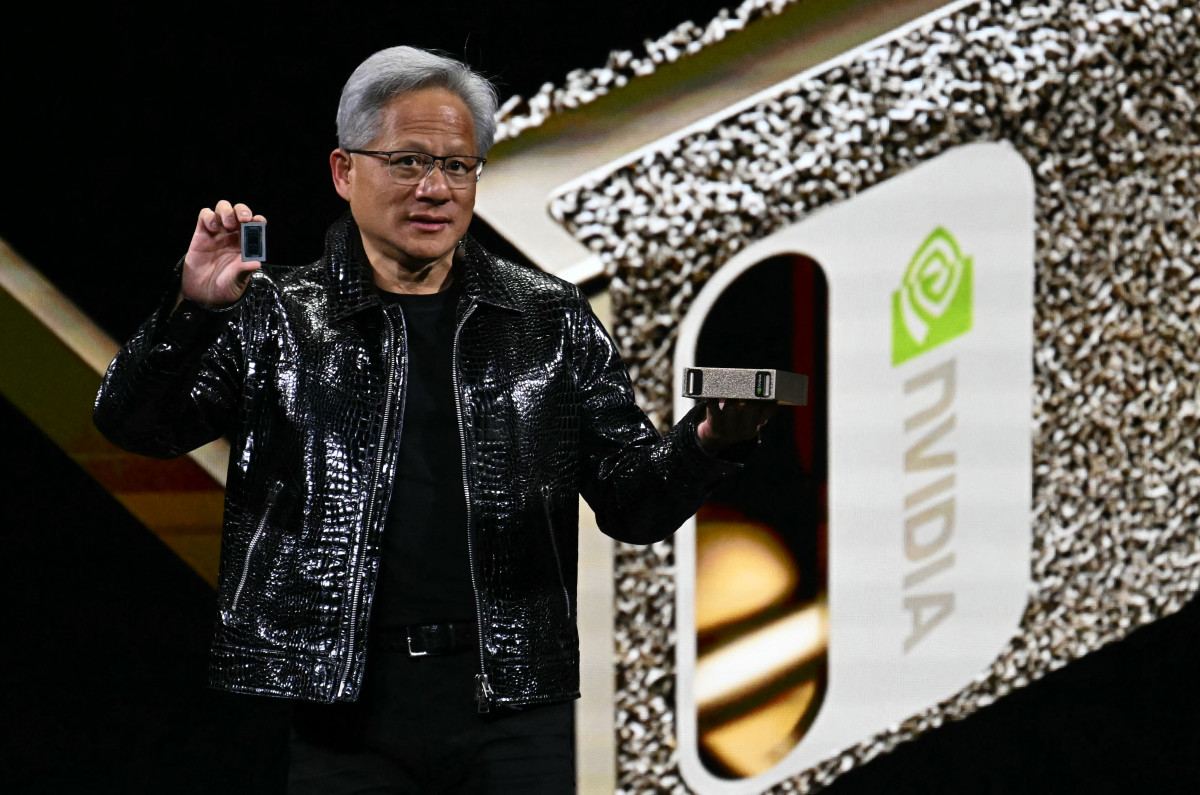

Photo by PATRICK T. FALLON on Getty Images

Nvidia’s setup heading into earnings

Nvidia will report earnings after the market closes on Nov. 19. The event is nothing less than Super Bowl weekend for the investing world. Nvidia’s earnings are less about the chip giant and more about the general state of AI adoption.

Nvidia previously informed investors to anticipate roughly $54 billion in sales for the third quarter of fiscal year 2026, give or take 2%. The company’s gross margins are expected to be in the mid-70s as its Blackwell AI platform expands among hyperscale clients.

Related: SoFi turned itself into a ‘crypto bank’: Here’s why that matters

Analysts watching Nvidia’s earnings expect:

- Data center AI demand drove a revenue increase of more than 50% year over year.

- Blackwell rack-scale systems and more expensive GPUs are making bigger contributions as hyperscalers raise AI expenditures again.

Nvidia’s main story hasn’t changed: It is at the heart of a worldwide surge in AI expenditure, and its roadmap (Blackwell now, Rubin next) continues pushing performance and price power higher.

More Nvidia:

- Nvidia makes a major push for quantum computing

- Nvidia’s next big thing could be flying cars

- Bank of America revamps Nvidia stock price after meeting with CFO

Nvidia’s relationship with Nokia, on the other hand, adds a new level to that tale. It expands Nvidia’s reach beyond data centers to 5G-Advanced and 6G mobile networks, as well as the optical infrastructure that links them.

That’s why the timing is important: Nvidia’s share in Nokia was completed only days before this earnings call, and investors will want to know how it fits into the company’s overall AI infrastructure plan.

How Nokia bet serves as Nvidia’s AI-networking play

The Nokia investment is minor compared to Nvidia’s total size and cash flow for now. It won’t change the figures for this quarter. However, the investment aligns well with three topics Nvidia is continuously discussing with investors.

First, Blackwell and the surrounding area need a better network. The new Blackwell platform, which is likely to be a major topic of conversation during this earnings conference, is designed to be both a chip and a rack-scale system. That provides greater value to high-speed networking, switches, and interconnects, which are areas in which Nvidia has been working diligently to expand.

Related: Warner Bros. Discovery just got a boost, and buyers are circling

Second, AI is making its way to the edge. Nvidia has long said that as AI workloads grow, it makes sense to put GPUs closer to where inferences are run, whether that’s in a factory, a car, or a cell tower.

AI-RAN is one of the most expensive variants of that idea. Base stations transform into micro AI data centers, where GPUs handle both radio and local AI tasks. Nvidia’s cooperation with Nokia is the clearest sign that it wants to transform that idea into a genuine product.

Third, Nvidia is using small stakes as a tool. Nvidia has a pattern of giving large minority stakes to ecosystem players and infrastructure partners, rather than buying them outright.

The Nokia deal is an example of this. It’s a method to achieve design victories, change roadmaps, and share profits without the risk of integration and the problems associated with dealing with regulations that come with complete acquisitions.

So when Nvidia talks about AI infrastructure on this call, it’s no longer just about GPUs in racks. The Nokia stake extends that definition to carrier networks.

What to listen for on Nvidia’s Nov. 19 earnings call

The upcoming earnings report is unlikely to feature the Nokia deal heavily. However, if Nvidia says the Nokia transaction represents a model for investing small amounts of money in strategically significant partners across various industries, it helps us understand how much more money it may spend in this way.

That is where things will get interesting for NVDA investors.

Related: Why Nvidia’s ‘big sellers’ might secretly be its biggest believers

#billion #bet #Nokia #stake #fits #Nvidia039s #roadmap