Good morning. Stock futures are little moved this morning after Trump’s tariffs went into effect, introducing higher levies on more than a dozen countries. After the changes, the average effective tariff rate for the U.S. will rise to 18.3%, per data from the Yale Budget Lab.

Update: 4:30 A.M. EDT

A.M. Earnings: Eli Lilly, ConocoPhillips, Brookfield

Earnings from energy and infrastructure firms will be at the forefront this morning,

Per Nasdaq, there are 468 earnings reports today, which makes this the busiest day of the second-quarter earnings season thus far.

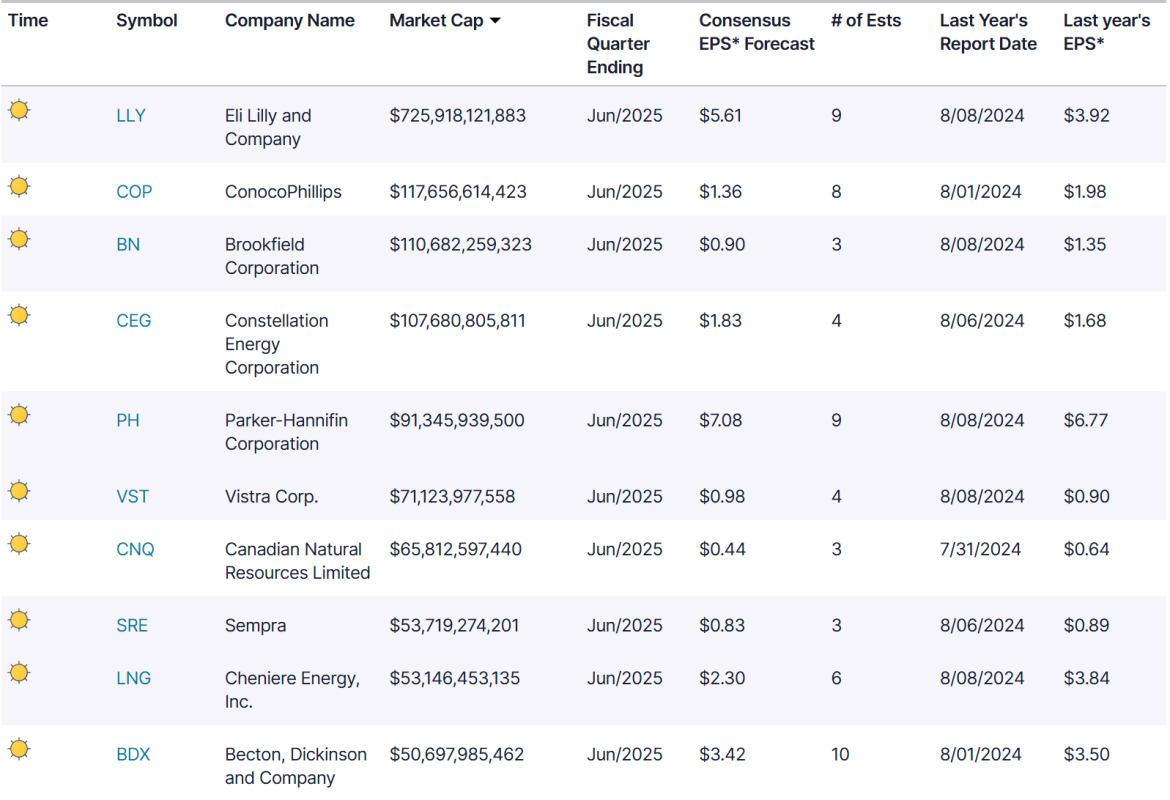

Here are the ten largest reports (by market cap) that will report this morning:

Nasdaq

A.M. Data: Jobless Claims, Productivity, Consumer Checkup

This morning, we’re looking out for a raft of both hard and soft economic data points. Atop the swath will be jobless claims data, which is bound to move stocks after the Trump Administration’s dramatic firing of Bureau of Labor Statistics commissioner Erika McEntarfer.

However, it won’t be the only datapoint to watch. Here are the highlights (which will be updated as the data comes in):

8:30 A.M. EDT

- Initial Jobless Claims (Previously: 218,000; 4-Week Average is 221,000)

- Continuing Jobless Claims (Prev: 1,946,000)

- Nonfarm Productivity (Prev: -1.5% quarter-over-quarter)

- Unit Labor Costs (Prev: +6.6% QoQ)

10:00 A.M. EDT

- Wholesale Inventories (Prev: -0.3% month-over-month)

11:00 A.M. EDT

- Consumer Inflation Expectations (Prev: +3%)

3:00 P.M. EDT

- Consumer Credit Change (Prev: +$5.1 billion)

Other Notes

- Fed speeches from Bostic at 10 A.M; Musalem at 10:20 A.M.

- Used car prices (+1.6% MoM; +6.3% YoY) also due out intraday

- The 4 and 8-week bill auctions are out at 11:30 A.M; the 30-year bond auction is out at 1:00 P.M.

- After market close, the Fed Balance Sheet is expected around 4:30 P.M. EDT.

#Stock #Market #Today #Trump #tariffs #effect #energy #earnings #approach