This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Tuesday. This is TheStreet’s Stock Market Today for Nov. 18, 2025. You can follow the latest updates on the market here in our daily live blog.

Update: 2:23 a.m. ET

A.M. Update: What We Know (So Far)

Good morning. We’d say that ‘today is another day’, but after three consecutive days of declines in the U.S. markets, we’re going to err on the side of caution and try not to jinx it. And there’s more reasons to not get our hopes up this morning, as equity futures look set to repeat the past once more.

The NasdaqComposite futures are currently pointing to a nearly 1% decline today, while the Russell 2000 and S&P 500 are looking at 0.89% and 0.69% declines at the open. Those make the Dow‘s 0.44% decline look pretty reasonable by contrast.

The declines come despite 82% of S&P 500 firms reporting an EPS surprise, while 76% reported a revenue surprise, per FactSet. And while negative outlooks have outstripped positive ones, earnings growth is seen coming in even hotter than expected thanks to the sheer volume of surprises.

There’s a lot of factors which could prove influential in the market this week:

Nvidia Earnings Incoming

For one, Nvidia‘s highly-anticipated earnings on Wednesday. Over the last few weeks — maybe due to a few too many AI CEO outbursts, or perhaps shadows cast from the bond market — there has been a newfound skittishness around the data center and AI trades. If the AI boom is indeed intact, or crumbling, it might be obvious as the world’s most-valuable firm reports.

Bitcoin, Begone?

It’s not worth ruling out what cryptocurrency markets can tell us about the state of the speculative retail trader. And after collapsing below $90,000 late Monday evening, the crypto market is flashing red. It could soldier back, but the weakness in crypto has already been seen boiling over to markets, as crypto-exposed equities, more speculative ‘low quality’ assets, and recent IPOs have come back to Earth.

It’s Tariff Time

There’s also the Trump tariff case, which recently reached the Supreme Court and elicited a range of skeptical questions, even from the court’s more conservative judges. And while the company of earnings calls talking about “tariffs” has declined considerably from last quarter, the end of tariffs could be a surprise.

Jobs, Jobs, Jobs?

Last, but certainly not least, we have jobs data we’ve been waiting weeks for. In fact, this one should’ve been out Oct. 1.

Feeling old yet?

This Thursday, traders will get a look at the long-overdue September payrolls, which is pretty stale at this point. It’ll more or less confirm what the public and privately-issued reports indicated, giving us some clues on the ongoing slowdown in the labor market.

This one is unlikely to be much of a market mover because of how ‘stale’ this data has gotten. After all, it’s almost December now!

Earnings + Economic Data

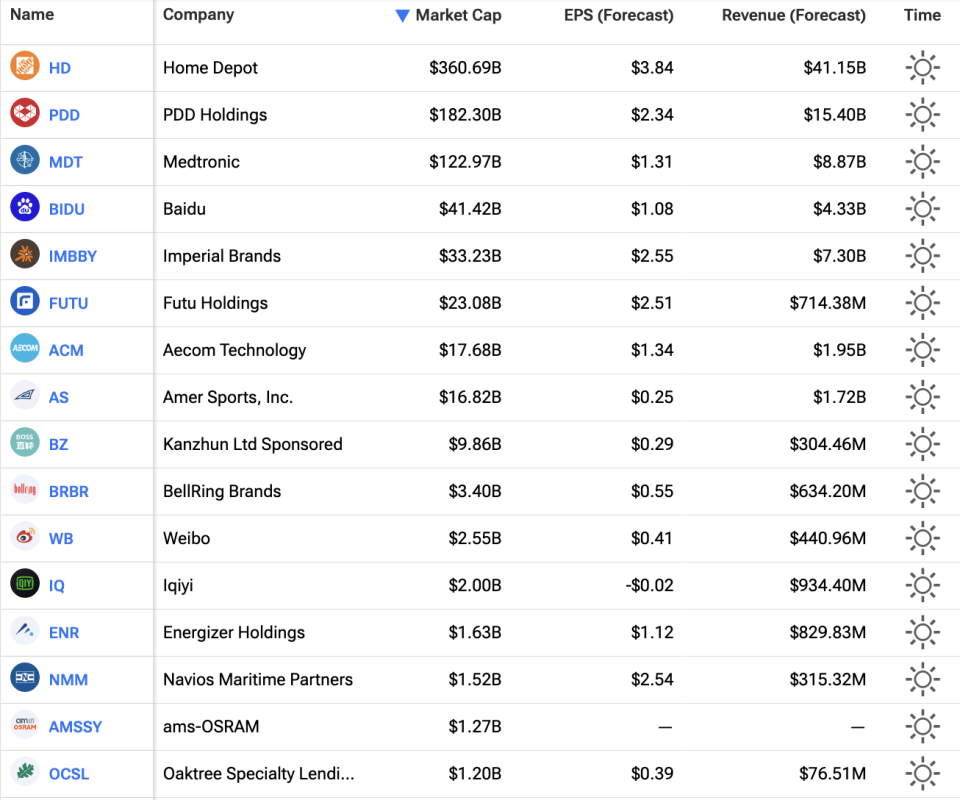

That said, this morning we’re on the look out for reports from Home Depot, PDD Holdings, and Medtronic, among others. Here’s the full list of A.M. reports (from firms with at least a $1 billion market cap) per TipRanks:

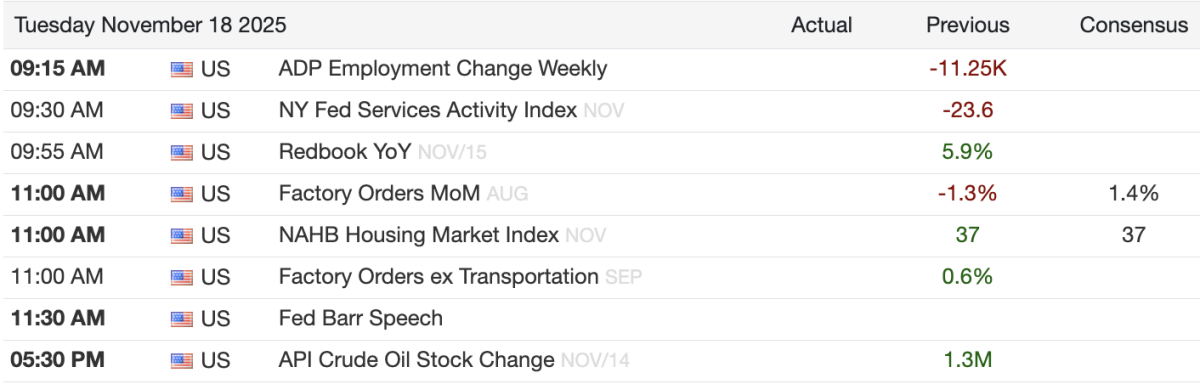

And on the heels of our bite-sized digest of big events to keep your eyes peeled for this week, here is what economic data or events you can expect this morning, anchored by the weekly ADP Employment Change data.

Of course, it’s important to keep tabs on other alternative data not listed here, too. We’ll have a short digest of some of the other data coming soon, so keep an eye on SMT.

#Stock #Market #Today #Futures #Point #Declines #Nasdaq #SampP #Tech #Crypto #Continue #DaysLong #Skid