The US economy has surged over the past two quarters, but not everyone is cheering. Much of the US economy’s strength has come from a flood of artificial intelligence spending, rather than because US consumers are feeling flush.

Millions of Americans are struggling to meet their everyday expenses, and with tariffs boosting inflation this year, it hasn’t gotten any easier.

While inflation retreated steadily in 2024, it has rebounded since April, when President Trump’s reciprocal tariff strategy was announced. Consumer Price Index, CPI, inflation was 3% in September, up from 2.3% in April.

U.S. CPI inflation rate in 2025 by month:

- September: 3%

- August: 2.9%

- July: 2.7%

- June: 2.7%

- May: 2.4%

- April: 2.3%

- March: 2.4%

- February: 2.8%

- January: 3%

Source: BLS

That’s not good news for U.S. workers, especially since cracks have formed in the U.S. job market. Unemployment wasn’t reported for September due to the shutdown in Washington, but it clocked in at 4.3% in August — the highest since 2021.

Meanwhile, the number of unfilled jobs shrank to 7.2 million in August, down from over 12 million in 2022, according to the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey, or JOLTS.

The decline in available jobs and a rise in layoffs as inflation rises has put the U.S. economy on a razor’s edge, and Bank of America’s latest report on worker pay suggests the situation is at risk of worsening.

Wages are growing more slowly than inflation for millions of workers

Bank of America is one of the largest banks in the United States. It was founded in 1904 and it serves about 70 million customers across over 3,700 branches.

Its status provides it with insight into a wide swath of America’s workers, providing it with a unique ability to gauge the health of the economy and households.

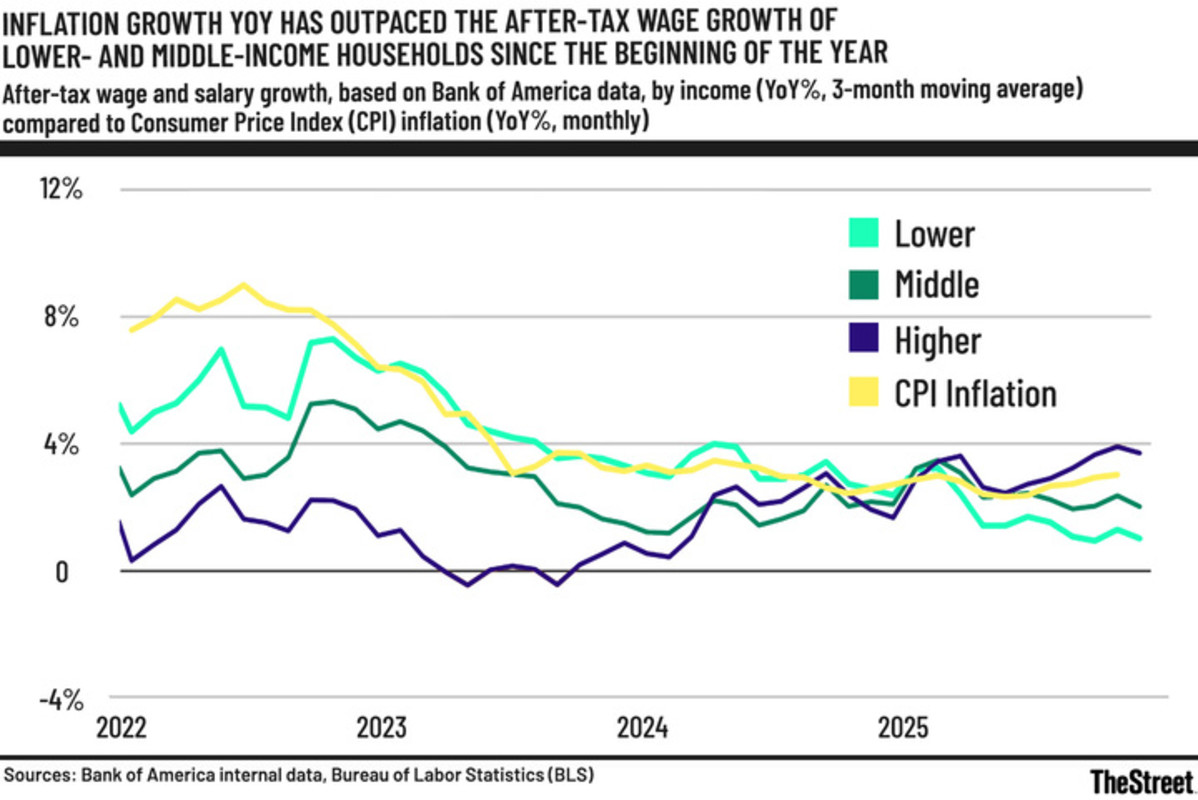

Its latest report crunching reveals a concerning trend: pay for most Americans isn’t keeping pace with inflation again. Only the highest-income earners are seeing wages grow faster than prices.

The slower-than-inflation pay growth for lower- and middle-income Americans is hitting millennials and Gen X the hardest.

“The number of lower-income households (especially Millennials and Gen X) living paycheck to paycheck continues to rise while there is almost no increase in the number of higher- and middle-income households,” said Bank of America’s analysts.

Low-income households living paycheck to paycheck by year:

- 2025: 29%

- 2024: 28.6%

- 2023: 27.1%

Source: Bank of America.

It’s been a different story for high-income Americans. While there has been a steady stream of layoffs in high-paying jobs, including those at major technology companies like Amazon and Microsoft, higher-income earners are still receiving bigger raises than inflation.

For example, higher-income millennials have seen their wages increase 5% faster than those of lower-income millennials. Pay bumps for Gen X high-income earners have outpaced lower-income earners by 4%.

Overall, higher-income earners experienced a 3.7% wage increase year over year in October.

Bank of America/TheStreet

“Wages for lower-income earners have been easing relative to their higher-income counterparts since the beginning of 2025, after having risen much faster in 2021-22, before cooling in 2023-24 and falling this year,” said Bank of America.

Retailers report widening gap

The hit to middle and low-income-earning households is reducing discretionary budgets and forcing many to rethink their spending. The latest trends in the fast-food industry are emblematic of the situation.

In its latest earnings call, McDonald’s CEO Chris Kempczinski said:

The spending trends in retail also reflect a shift toward discount retailers, such as T.J. Maxx, Marshalls, Burlington Stores, and Dollar Tree.

“Discount apparel spending accelerated to 3.3% [year over year] in October,” said Bank of America retail analysts in a research note shared with TheStreet.

That’s a sharp contrast to spending at department stores, which has been flat or negative compared to the prior year every month since March. In the week ending Nov. 1, higher income consumers spent 1.1% more than last year at department stores, while lower income consumers spent 2.7% less.

“The spread in clothing spending between low-income and high-income households remains high as inflation continues to have an outsized impact on lower-income spending across industries,” said the analysts.

The dynamic isn’t overly reassuring because it suggests that the US economy is becoming increasingly reliant on the spending of high-income earners. If job trends worsen or we see a downturn in the stock market or home values, it could send the economy reeling.

Related: Fed official forecasts huge economic shift coming soon

#Bank #America #raises #red #flag #worker #wages