For many investors, the Nasdaq 100 is their proxy for the tech sector. In reality, only about 61% of the fund’s assets are invested in companies that are categorized as tech, but considering that the index’s top 10 holdings include all of the magnificent 7 names as well as adjacent names, including Broadcom and Netflix, it’s safe to say that it’s very tech-influenced.

The Invesco QQQ ETF (QQQ), which tracks the performance of the Nasdaq 100, is currently the 5th largest ETF with nearly $400 billion in AUM and is the 2nd most traded (based on average daily dollar volume over the past 30 days). Given the rally in tech stocks and the AI boom since the 2022 market bottom, QQQ may arguably be the most popular ETF in the world right now.

In 2020, Invesco launched two new ETFs to add to the QQQ suite – the Invesco Nasdaq 100 ETF (QQQM) and the Invesco Nasdaq Next Gen 100 ETF (QQQJ). The objective was to give investors access to a broader universe of high-innovation companies and do so in a more cost-competitive way.

How do these three ETFs compare and, more importantly, how would they fit together in a portfolio?

QQQ & QQQM: Both track the Nasdaq 100, What’s the difference?

When you put QQQ & QQQM side-by-side, one thing becomes abundantly clear. They both track the same index, the Nasdaq 100.

You might wonder why Invesco would launch an ETF that’s effectively a clone of one it already has. The answer is cost.

QQQM has an expense ratio of 0.15% compared to 0.20% for QQQ. That makes QQQM the cheaper one to own and the better choice for most retail investors, especially those intending to buy and hold. QQQ due to its high liquidity may still work better for big institutional traders.

Related: Forget VOO, SPY, VTI: Best stock investing pick is this Fidelity fund

QQQJ: Investing in the “next” Nasdaq 100 components

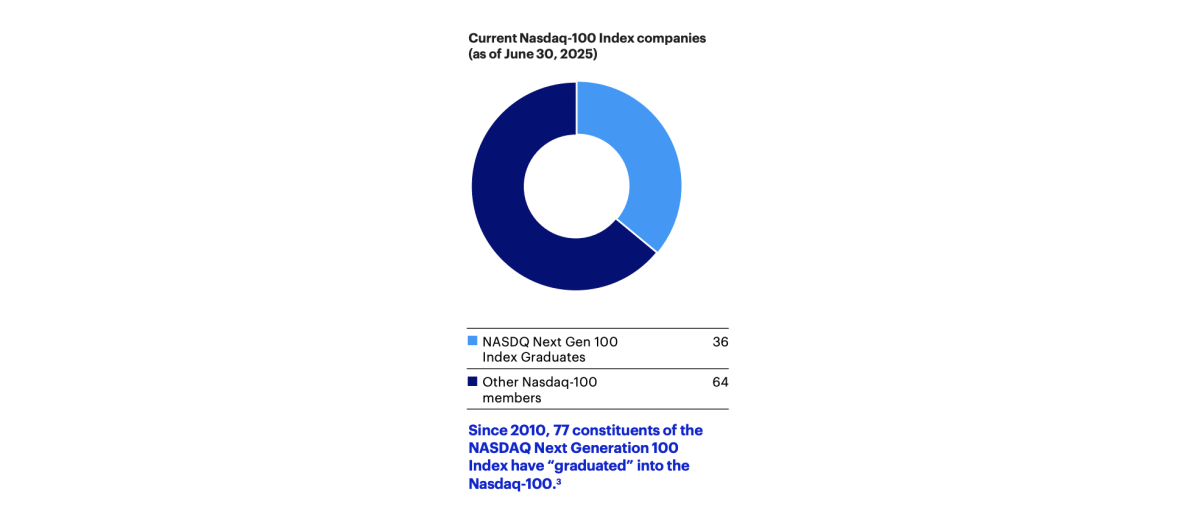

If QQQ invests in the 100 largest non-financial stocks traded on the Nasdaq, QQQJ invests in the next 100 after that (ranked by market cap). In many cases, QQQJ components are considered the emerging up-and-comers that could join the “big” index in the near future. In fact, more than ? of current Nasdaq 100 components were members of the Next Gen 100 index at one time.

It’d be a mistake, though, to assume that QQQJ’s composition is substantially similar to that of QQQ. The latter has more than 60% of assets committed to tech and more than 50% to just the top 10 holdings, including all of the magnificent 7 names.

QQQJ, however, has a more modest 32% invested in tech, while the top 10 holdings account for just 21% of assets. Both ETFs hold 100 stocks, but QQQJ is much more balanced from top to bottom. The biggest difference between the two funds: healthcare. QQQ has just 5% in this sector. QQQJ has more than 20%.

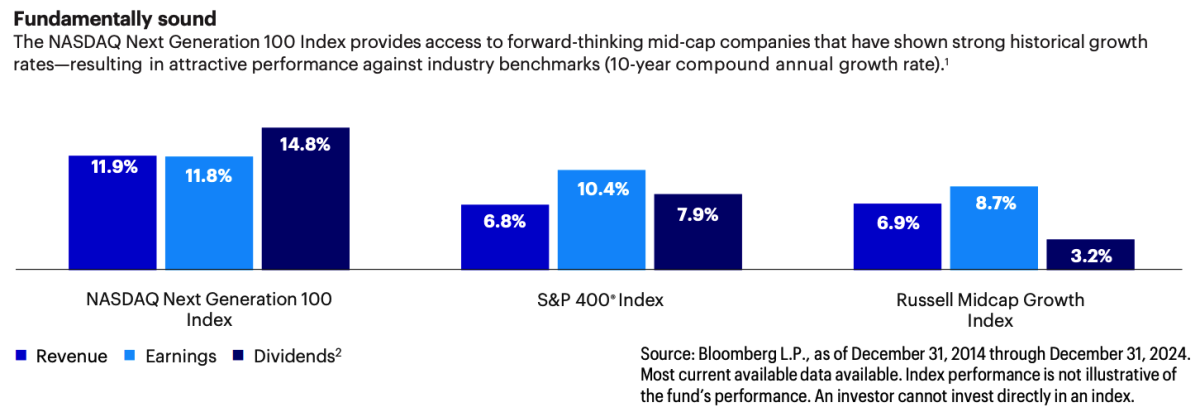

According to Invesco research, QQQJ also has a fairly substantial quality tilt when compared to some of its mid-cap counterparts.

Historically, QQQJ has demonstrated greater revenue, earnings and dividend growth over the past decade. While emerging innovators will probably never be known for their generous dividend payouts, the fact that these companies have delivered demonstrably better income statement improvement suggests the potential for above-average returns over time.

Key Takeaways:

- QQQJ invests in the “next” 100 innovation stocks after the Nasdaq 100.

- QQQJ is more diversified and better balanced than QQQ.

- QQQJ has a substantially higher allocation to healthcare stocks.

- The “next gen” Nasdaq stocks have historically demonstrated greater revenue & profit growth than their mid-cap peers.

Augmenting the Nasdaq 100 with the next-gen Nasdaq 100

There’s a strong case for why either QQQ or QQQM could pair nicely with QQQJ.

While the Nasdaq 100 ETFs are heavily concentrated in well-established mega-cap tech giants, QQQJ focuses on companies that are mostly still in their growth phase. Pairing up-and-coming innovation companies with more mature ones helps provide exposure to both ends of the economic cycle.

The size of companies in the two indexes is very different. The sector exposures are different. These are the factors that can add real diversification benefits when paired together in a portfolio. Plus, you wouldn’t necessarily be sacrificing balance sheet quality in the process.

Final Thoughts: comparing QQQ, QQQM and QQQJ

Given the cost advantage, most investors will be better off choosing QQQM over QQQ for their Nasdaq 100 exposure.

QQQJ is a high-potential growth vehicle that deserves attention. There’s a demonstrated history of companies “graduating” into the Nasdaq 100, and many of these names are already exhibiting healthy balance sheets and solid revenue growth. It’s not a guarantee of success, but it’s a good start.

Related: US government shutdown: 5 ETFs to consider, and one to avoid

#QQQ #QQQM #QQQJ #Present #tech #Future #innovation