Roughly 70 million older adults who collect Social Security or Supplemental Security Income (SSI) are on track to get a raise next year — about 2.7% — according to the Senior Citizens League.

What does that mean in real dollars? If you’re receiving $2,000 a month, you could see an extra $54 in your check — that’s $648 more over the course of the year.

? Don’t miss the move: SIGN UP for TheStreet’s FREE daily newsletter ?

The League’s projection comes right on the heels of new inflation numbers from the Labor Department. Headline inflation — that’s the overall rise in consumer prices — came in at 2.7% for the 12 months ending in July. Strip out food and energy, and prices rose 3.1%.

Image source: Josue Michel on Unsplash

Inflation is still taking a bite for older Americans

It’s also worth noting that the Bureau of Labor Statistics tracks a research index designed specifically for older Americans — the Consumer Price Index for Americans 62 and Older, or R-CPI-E.

This measure looks at the spending patterns of older households — think more health care, less gasoline — to see how inflation affects retirees.

Over the past year, it showed prices rising 2.8% for older Americans, a notch higher than the overall rate. In other words, at today’s pace, inflation is biting seniors just a bit harder than the general population.

Related: Social Security COLA for 2026: What Retirees Can Expect

“With the COLA announcement around the corner, seniors across America are holding their breath,” said Senior Citizens League Executive Director Shannon Benton.

“While a higher COLA would be welcome because their monthly benefits will increase, many will be disappointed. TSCL’s research shows that many seniors believe the COLA does not adequately capture the inflation they experience.”

With two months to go before the official COLA announcement, the League’s monthly forecast has been inching higher since May — a sign that inflation pressures could pick up again.

More Retirement:

- Suze Orman debunks White House claim on Social Security tax break

- Jean Chatzky shares retirement tips on Social Security, Medicare

- Warren Buffet’s blunt Social Security warning is becoming reality

The group will release its final projection in September, and the government will announce the official 2026 COLA in October.

A quick refresher on how this works: Since 1973, Social Security benefits have been tied to inflation through an annual cost-of-living adjustment, or COLA.

The formula looks at the average Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) in the third quarter — July through September — and compares it to the same period a year earlier. The CPI-W for Q3 2024 was 303.420.

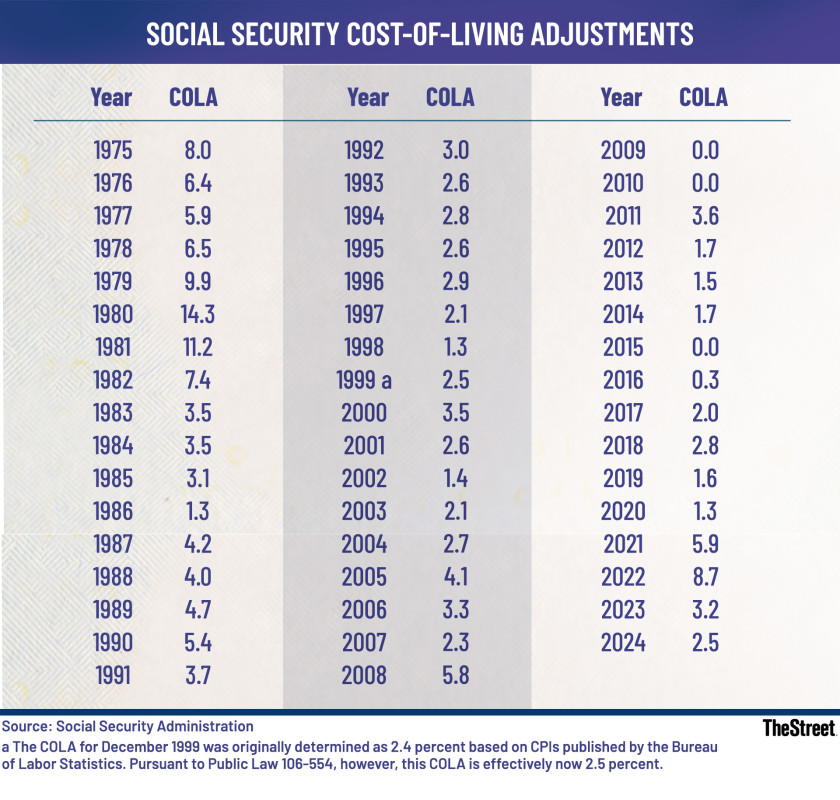

Historically, COLAs have averaged 3.7% since 1975, but in more recent years they’ve been closer to 2.6%. For 2025, the increase was 2.5% — exactly what the Senior Citizens League predicted.

Source: SSA

The real impact of your Social Security raise

One thing to keep in mind: Medicare Part B premiums are also going up. The standard monthly premium is expected to rise by at least $21.50 in 2026.

Since most beneficiaries have that amount deducted directly from their Social Security checks, the real “take-home” increase will be closer to $32.50 a month — roughly $390 for the year.

And while any increase is welcome, Benton said it comes at a time when many older Americans are struggling to access basic needs.

“American seniors’ lack of access to basic amenities in their communities is a major challenge,” she said. “Our research shows a statistically significant connection between convenient access to health care and entertainment services and seniors who are more satisfied with their current lives. Seniors with free or subsidized access to public transport also report higher life satisfaction.”

The League’s 2025 Lifestyle Report found that millions of seniors travel more than 30 minutes for health care or entertainment — and those with such long trips tend to report lower satisfaction and higher rates of negative emotions.

Public transportation isn’t helping much: 29% of seniors say they have no access to it, and another 26% aren’t sure if it’s even available in their communities.

Related: White House makes risky changes to retirement accounts

#Social #Security #recipients #track #COLA #increase